UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| Definitive Proxy Statement | ||||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||||||

SANGAMO THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||||||||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

Title of each class of securities to which the transaction applies: | ||||||||||||||

Aggregate number of securities to which the transaction applies: | ||||||||||||||

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||||||||

Proposed maximum aggregate value of the transaction: | ||||||||||||||

Total fee paid: | ||||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

Amount Previously Paid: | ||||||||||||||

Form, Schedule or Registration Statement No.: | ||||||||||||||

Filing Party: | ||||||||||||||

Date Filed: | ||||||||||||||

SANGAMO THERAPEUTICS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 18, 202025, 2021

To the Stockholders of Sangamo Therapeutics, Inc.:

You are cordially invited to attend the 20202021 Annual Meeting of Stockholders, or the Annual Meeting, of Sangamo Therapeutics, Inc., a Delaware corporation (referred to herein as the Company, Sangamo, we or we)us). The meetingIn light of public health concerns regarding the ongoing COVID-19 pandemic, and to protect the health and safety of our stockholders and employees, and to facilitate stockholder participation in the Annual Meeting, the Annual Meeting will be held in an online-only format through a live webcast at www.meetingcenter.io/200857739on Monday,Tuesday, May 18, 2020,25, 2021, at 9:008:30 a.m. Pacific Time atTime. You will not be able to attend the Grand Hyatt at SFO, meeting in person.55 South McDonnell Road, San Francisco, California 94128*, The Annual Meeting will be held for the following purposes:

1.to elect the nine nominees for director named in the accompanying proxy statement, or the Proxy Statement, to serve on the Board of Directors until the next annual meeting of stockholders to be held in 2022 and until their successors are duly elected and qualified;

2.to approve, on an advisory basis, the compensation of our named executive officers, or NEOs, as described in the accompanying Proxy Statement;

3.to approve the Sangamo Therapeutics, Inc. 2020 Employee Stock Purchase Plan, or the 2020 ESPP, pursuant to which 5,000,000 shares of our common stock will be available for sale and issuance to our employees;

4.to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021; and

5.to transact such other business as may properly come before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 20, 2020.31, 2021. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment or postponement thereof.

At the time and date of the Annual Meeting, stockholders will be able to inspect a list of stockholders of record in the meeting center at www.meetingcenter.io/200857739 for any purpose germane to the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May The Proxy Statement, Proxy Card and Annual Report on Form 10-K for www.envisionreports.com/SGMO | ||

| Sincerely, | |||||

| |||||

| Alexander D. Macrae | |||||

| President and Chief Executive Officer | |||||

Brisbane, California

April 2, 2021

YOUR VOTE IS VERY IMPORTANT

You are cordially invited to attend the Annual Meeting | ||

TABLE OF CONTENTS

| Page | |||||

A- | |||||

SANGAMO THERAPEUTICS, INC.

7000 Marina Boulevard

Brisbane, California 94005

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 18, 202025, 2021

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

Our Board of Directors (referred to herein as the Board of Directors or the Board) is soliciting your proxy to vote at the Annual Meeting including at any adjournments or postponements of the Annual Meeting. This Proxy Statement contains important information regarding the Annual Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote and voting procedures. You are invited to attend the Annual Meeting online to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions found below to submit your proxy over the telephone or through the Internet.

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials over the Internet. Most of our stockholders holding their shares in “street name” will not receive paper copies of our proxy materials (unless requested), and will instead be sent a Notice of Internet Availability of Proxy Materials, or Notice, from the brokerage firms, banks or other agents holding their accounts. All “street name” stockholders receiving a Notice will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

Why did I receive a full set of proxy materials in the mail instead of a notice regarding the internetInternet availability of proxy materials?

We are providing stockholders of record who are holding shares in their own name and stockholders who have previously requested a printed set of our proxy materials with paper copies of our proxy materials instead of a Notice. We intend to mail a full set of proxy materials to our stockholders of record on or about April 12, 2021.

How do I attend and vote at the Annual Meeting as a stockholder of record?

In light of public health concerns regarding the ongoing COVID-19 pandemic, and to protect the health and safety of our stockholders and employees, and to facilitate stockholder participation in the Annual Meeting, the Annual Meeting will be held through a live webcast at www.meetingcenter.io/200857739 on Tuesday, May 25, 2021, 2020.at 8:30 a.m. Pacific Time. You will not be able to attend the Annual Meeting in person. At the time and date of the Annual Meeting, Sangamo stockholders of record as of March 31, 2021 can attend and vote by accessing the meeting center at www.meetingcenter.io/200857739 and entering the 15-digit control number on the proxy card or Notice. The meeting password is SGMO2021. Stockholders of record can vote their shares by clicking on the “Cast Your Vote” link in the meeting center.

How do I register to attend and vote at the Annual Meeting as a beneficial owner?

Beneficial stockholders as of March 31, 2021 (i.e., shares held in “street name” through an intermediary, such as a bank or broker) must register in advance to attend and vote online at the Annual Meeting. To register, stockholders must obtain a legal proxy from the holder of record and submit proof of legal proxy reflecting the number of shares of Sangamo common stock held as of March 31, 2021, along with name and email address, to Computershare at legalproxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and must be received no later than Thursday, May 20, 2021, 2:00 p.m. Pacific Time. Stockholders will then receive a confirmation of registration with a control number by email from Computershare. At the time and date of the annual meeting, registered beneficial stockholders can attend by accessing the meeting center at www.meetingcenter.io/200857739 and entering the 15-digit control number on the proxy card or Notice. The meeting password is SGMO2021. Registered beneficial owners can vote their shares by clicking on the “Cast Your Vote” link in the meeting center.

1

What if I cannot find my control number?

If you are a stockholder of record, you will find your control number in the shaded bar or below the voting instructions on the front of the proxy card or Notice you received. Please enter the control number without any spaces. If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other holder of record), in order to obtain a control number, you will need to obtain a legal proxy from the holder of record and submit proof of legal proxy in accordance with the instructions in the preceding question above. If you are not able to find your control number or obtain a control number, you may attend the Annual Meeting as a guest, but you will not be able to vote your shares or ask questions during the Annual Meeting.

How do I attend the Annual Meeting?Meeting as a guest?

How do I ask questions at the Annual Meeting?

Stockholders of record or registered beneficial owners will be held on Monday, May 18, 2020allowed to submit questions and comments before and during the Annual Meeting. You may submit questions before the Annual Meeting at 9:00 a.m. Pacific Timewww.meetingcenter.io/200857739. During the Annual Meeting, you may only submit questions online to Sangamo’s representatives in the question box provided at www.meetingcenter.io/200857739. In both cases, stockholders must have available their 15-digit control number provided in the Notice or your proxy card (if you received a printed copy of the proxy materials). We will respond to as many inquiries at the Grand HyattAnnual Meeting as time allows.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the meeting center?

We will have technicians ready to assist you with any technical difficulties you may have accessing the meeting center at SFO, 55 South McDonnell Road, San Francisco, California 94128. Directionswww.meetingcenter.io/200857739. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

How can I access the list of stockholders of record?

At the time and date of the Annual Meeting, stockholders will be able to inspect a list of stockholders of record in the meeting center at www.meetingcenter.io/200857739 for any purpose germane to the Annual Meeting. Stockholders may also request to view a list of stockholders of record for 10 days prior to the Annual Meeting may be found at . Information on howby sending an email to vote in person at the Annual Meeting is discussed below.

What am I voting on?

There are fivefour matters scheduled for a vote:vote at the Annual Meeting:

•election of the nine nominees for director (Proposal No. 1);

•advisory approval of the compensation of our NEOs as disclosed in this Proxy Statement in accordance with SEC rules (Proposal No. 2);

•approval of the amendment and restatement of the 2018 Plan2020 ESPP, pursuant to among other things, increase the aggregate number ofwhich 5,000,000 shares of our common stock reservedwill be available for sale and issuance under the 2018 Plan by 9,900,000 sharesto our employees (Proposal No. 3); and

•ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 20202021 (Proposal No. 5)4).

What if another matter is properly brought before the meeting?Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting,Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For each of the other matters to be voted on at the Annual Meeting, including each nominee for director, you may vote “For” or “Against” or abstain from voting.

2

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in persononline at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend and vote online at the meetingAnnual Meeting even if you have already voted by proxy.

•To vote in person, come toat the Annual Meeting, and we will give you a ballot when you arrive.click on the “Cast Your Vote” link in the meeting center at www.meetingcenter.io/200857739.

•To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) within the United States, U.S. territories and Canada using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your telephone vote must be received by 1:00 a.m. Eastern Time on May 18, 202025, 2021 to be counted.

•To vote through the Internet, go to http://www.envisionreports.com/SGMO to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your Internet vote must be received by 1:00 a.m. Eastern Time on May 18, 202025, 2021 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. SimplyTo vote prior to the Annual Meeting, simply follow the voting instructions in the Notice to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in persononline at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact that organization to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. | ||

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of March 20, 2020.31, 2021.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote through the Internet, by telephone, by completing ayour proxy card or in persononline at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted “For” each of the proposals, including for each nominee for director. If any other matter is properly presented at the meeting,Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange, or NYSE, brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, we have been advised by the NYSE that Proposal Nos. 1, 2 and 3 are considered to be “non-routine” under NYSE rules meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. We have also been advised by the NYSE that Proposal Nos.No. 4 and 5 areis considered a “routine” mattersmatter under NYSE rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on such proposals.proposal.

3

If you are a beneficial owner of shares held in street name, to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. In addition, we have retained Innisfree M&A Incorporated, a proxy solicitation firm, to assist in the solicitation of proxies for a fee of approximately $15,000, plus reimbursement of certain costs and expenses. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials, or more than one Notice, or combination thereof?

If you receive more than one set of proxy materials, or more than one Notice, or combination thereof, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each set of proxy materials or Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting.Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may grant a subsequent proxy by telephone or through the Internet.

•You may submit another properly completed proxy card with a later date.

•You may send a timely written notice that you are revoking your proxy to our Secretary at 7000 Marina Boulevard, Brisbane California 94005.P.O. Box 505000, Louisville, KY 40233-5000. Such notice will be considered timely if it is received at the indicated address by the close of business on Friday,Thursday, May 15, 2020.20, 2021.

•You may attend the Annual Meeting via the live webcast and vote your shares online by clicking on the “Cast Your Vote” link in person.the meeting center at www.meetingcenter.io/200857739. Simply attending the Annual Meeting via the live webcast will not, by itself, revoke your proxy.

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting,Annual Meeting, who will separately count votes “For” and “Against,” abstentions and, if applicable, broker non-votes.

What are “broker non-votes?”

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” We have been advised by the NYSE that Proposal Nos. 1, 2 and 3 are considered to be “non-routine” under NYSE rules and we therefore expect broker non-votes to exist in connection with those proposals.

As a reminder, if you are a beneficial owner of shares held in street name, to ensure your shares are voted in the way you would prefer, youmustprovide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agentagent.

4

How many votes are needed to approve each proposal? How are abstentions and broker non-votes treated?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non- Votes | ||||||||||||||||||||||

| Election of directors | As this is an uncontested election, each director nominee must receive “For” votes from the majority of the votes cast on his or her election (i.e., the number of votes cast “For” a nominee’s election must exceed the number of votes cast “Against” that nominee’s election). Pursuant to our | No effect | No effect | |||||||||||||||||||||||

| Advisory approval of the compensation of our named executive officers | “For” votes from holders of a majority in voting power of the shares present | Against | No effect | |||||||||||||||||||||||

| Approval of the | “For” votes from holders of a majority in voting power of the shares present | Against | No effect | |||||||||||||||||||||||

| Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, | “For” votes from holders of a majority in voting power of the shares present | Against | Brokers have discretion to vote(1) | |||||||||||||||||||||||

___________________

(1)This proposal is considered a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent |

has discretionary authority under NYSE rules to vote your shares on this proposal. For more information, see “If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with my voting instructions, what happens?” and “What are broker‘broker non-votes?’” above. As a reminder, if you are a beneficial owner of shares held in street name, to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agentagent.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority in voting power of the outstanding shares entitled to vote are present at the meeting in persononline or represented by proxy.proxy at the Annual Meeting. On the record date, there were 116,211,355143,713,525 shares of common stock outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in persononline at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the Chair of the Board, without a stockholder vote, or the stockholders so present, by a majority in voting power thereof, may adjourn the meeting to another date without a stockholder vote.date.

5

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December , 2020,13, 2021, to our Corporate Secretary at 7000 Marina Boulevard, Brisbane, California 94005, and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. However, if our 2022 Annual Meeting of Stockholders is not held between April 25, 2022 and June 24, 2022, then the deadline will be a reasonable time prior to the time that we begin to print and mail our proxy materials.

Pursuant to our Bylaws, if you wish to bring a proposal before the stockholders or nominate a director at the 20212022 Annual Meeting of stockholders,Stockholders, but you are not requesting that your proposal or nomination be included in next year’s proxy materials, you must notify our Corporate Secretary, in writing, not later than the close of business on February 17, 202124, 2022 nor earlier than the close of business on January 18, 2021.25, 2022. However, if our 20212022 Annual Meeting of stockholdersStockholders is not held between April 18, 202125, 2022 and June 17, 2021,24, 2022, to be timely, notice by the stockholder must be received not later than the 10th day following the day on which the first public announcement of the date of the 20212022 Annual Meeting is made or the notice of the meeting is mailed, whichever first occurs. You are also advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

The chair of the Annual Meeting may determine, if the facts warrant, that a matter has not been properly brought before the meeting and, therefore, may not be considered at the meeting. In addition, the proxy solicited by the Board for the 20212022 Annual Meeting of Stockholders will confer discretionary voting authority with respect to any proposal (i) presented by a stockholder at that meeting for which we have not been provided with timely notice and (ii) made in accordance with our Bylaws, if (x) the 20212022 proxy statement briefly describes the matter and how management’s proxy holders intend to vote on it, and (y) the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act.

6

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

General

Our Board currently consists of nine directors and there are nine nominees for director this year. Proxies may not be voted for a greater number of persons than the number of nominees named in this Proxy Statement. Each director to be elected and qualified will serve until the next annual meeting of stockholders and until a successor for such director is duly elected and qualified, or until the earlier death, resignation or removal of such director. The nominees for election have agreed to serve if elected, and management has no reason to believe that such nominees will be unavailable to serve. In the event the nominees are unable or decline to serve as directors at the time of the Annual Meeting, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees named below.

Each of the nine nominees, other than John H. Markels, Ph.D. and James R. Meyers,Dr. Kenneth J. Hillan, has been previously elected by our stockholders. Dr. MarkelsHillan was initially recommended to the Nominating and Corporate Governance Committee of the Board, or the Nominating and Governance Committee, by our Chief Executive Officer upon the recommendation of another executive officer. Mr. Meyers was originally identified as a director candidate by a third-party recruiting firmBoard Director. Following this recommendation, the Board interviewed and then recommended by our Chief Executive Officervetted Dr. Hillan prior to electing him to the Nominating and Corporate Governance Committee.Board. While the Nominating and Corporate Governance Committee and the Board chose to nominate Dr. Alexander D. Macrae, our Chief Executive Officer, for election to the Board for the reasons set forth in his biography below, Dr. Macrae’s employment agreement also provides that the Board shall nominate Dr. Macrae for election as a member of the Board at each annual meeting of stockholders occurring while Dr. Macrae’s employment agreement is in effect.

Each of the nine nominees set forth in this Proxy Statement will be elected by the majority of the votes cast with respect to such nominee, which means that the number of votes “For” a nominee’s election must exceed the number of votes “Against” that nominee (with abstentions and broker non-votes not counted as either a “For” or “Against” vote for that nominee’s election). If an incumbent director does not receive the required majority vote, the director is required under our Bylaws to promptly tender his or her resignation to the Board. Within 90 days after the Annual Meeting, the Nominating and Corporate Governance Committee of the Board will make a recommendation to the Board of Directors as to whether to accept or reject the resignation. The Board will act by taking into account such committee’s recommendation. If the Board does not accept the resignation, the Board is required to publicly disclose its decision and the rationale behind the decision.

The following includes a brief biography of each nominee for director, including their respective ages as of March 20, 2020.31, 2021. Each biography includes information regarding the specific experience, qualifications, attributes or skills that led the Nominating and Corporate Governance Committee and the Board to determine that the applicable nominee should serve as a member of the Board as of the date of this proxy statement.Board.

Nominees

Alexander D. Macrae, M.B., Ch.B., Ph.D., age 57,58, has served as our President and Chief Executive Officer and as a member of our Board of Directors since June 2016. Dr. Macrae also serves on the board of directors of 4D Pharma plc.plc, a biopharmaceutical company. He has over twenty20 years of experience in the pharmaceutical industry most recently serving as the Global Medical Officer of Takeda Pharmaceuticals,Pharmaceutical Company Limited, or Takeda, a public global biopharmaceutical company, from 2012 to March 2016, where he established and led the Global Medical Office, which encompassesencompassed medical affairs, regulatory affairs, pharmacovigilance, outcomes research and epidemiology, quantitative sciences and knowledge and informatics. From 2001 to 2012, Dr. Macrae held roles of increasing responsibility at GlaxoSmithKline plc, or GSK, a public global healthcare company, including Senior Vice President, Emerging Markets Research and Development, or R&D, from 2009 to 2012. In that position, he provided expertise and resources to create a first-of-its-kind group to expand GSK’s global reach by providing R&D strategies, clinical development and regulatory resources to enter emerging markets and Asia-Pacific. From 2007 to 2008, he was Vice President, Business Development. In that position, he was responsible for scientific assessment and business development project leadership for the neurology, psychiatry, cardiovascular and metabolic therapeutic areas. Earlier in his career, he worked for SmithKline Beecham, where he was responsible for clinical development in the therapeutic areas of neurology and gastroenterology. Dr. Macrae received his B.Sc. in pharmacology and his M.B., Ch.B. with honors from Glasgow University. He is a member of the Royal College of Physicians. Dr. Macrae also earned his Ph.D. in molecular genomics at King’s College, Cambridge. The Nominating and Corporate Governance Committee and the Board believe that Dr. Macrae’s day-to-day leadership and intimate knowledge of our business and operations, as well as our relationships with partners, collaborators and investors, provides the Board with an in-depth understanding of the Company.

Robert F. Carey, age 61,62, has served as a member of our Board of Directors since June 2016. Mr. Carey has served as executive viceco-founder, president and chief businessoperating officer of ACELYRIN, Inc., a privately-held biopharmaceutical company, since July

7

2020. Mr. Carey served as Executive Vice President, Chief Business Officer for Horizon PharmaTherapeutics plc, a biopharmaceutical company, from March 2014 to October 2019. Prior to that, he served as managing director and head of the healthcare investment banking group at JMP Securities LLC, a full-service investment bank from March 2003 to March 2014. Prior to JMP, Mr. Carey was a managing director in the healthcare

groups at Dresdner Kleinwort Wasserstein and Vector Securities International, Inc. He has also held roles at Shearson Lehman Hutton and Ernst & Whinney. Mr. Carey also serves on the board of directors of Beyond Air, Inc. (formerly AIT Therapeutics, Inc.)., a public medical device and biopharmaceutical company. Mr. Carey previously served on the board of directors of FS Development Corp., a public blank-check company now known as Gemini Therapeutics, Inc., from July 2020 to February 2021. Mr. Carey received his B.S.BBA in accountingaccountancy from the University of Notre Dame. The Nominating and Corporate Governance Committee and the Board believe that Mr. Carey’s extensive experience and knowledge in the healthcare investment banking industry, particularly with financings, global expansion and other strategic transactions by life-science companies, as well as his role in senior management and business development for a public biopharmaceutical company, provides the Board with valuable insight and contribution.

John H. Markels, Ph.D., age 54,55, has served as a member of our Board of Directors since February 2020. Dr. Markels has over 30 years of leadership experience in the pharmaceutical industry. Since January 2019, he has served as President of Global Vaccines at Merck & Co., Inc., or Merck, where he leads an integrated team dedicated to discovery and development, supply and access, and global marketing and long-term strategy for the vaccines portfolio. Earlier roles at Merck included President, Latin America from January 2018 to January 2019, SVP, Global Human Health Business Strategy from January 2017 to December 2017, Managing Director, Mexico from November 2013 to January 2017, as well as2017. Prior to his commercial roles, he had a long career in senior leadership positions in major regions worldwide inglobal manufacturing, including operations leadership for Europe, Middle East and Africa, Asia Pacific and emerging markets as well as manufacturing technology operations and product development roles in pharmaceutical active pharmaceutical ingredients (API) and vaccines. Throughout his tenure at Merck, Dr. Markels has led multiple enterprise level strategy business development, alliance management,efforts including the Merck manufacturing strategy, portfolio strategy, small molecule commercialization strategy and supply chain.others. Dr. Markels received his Ph.D. in chemical engineering from the University of California, Berkeley and his B.S. in chemical engineering from the University of Delaware. The Nominating and Corporate Governance Committee and the Board believe that Dr. Markels’ extensive leadership experience in operations, strategy and development provides valuable operational, strategy and management skills to the Board.

James R. Meyers, age 55,56, has served as a member of our Board of Directors since November 2019. He has over 30 years of commercial leadership experience in the biotechnology industry. Since November 2020, Mr. Meyers workedhas served as President and Chief Executive Officer of IntraBio Ltd., a privately-held biopharmaceutical company. Previously, Mr. Meyers held positions of increasing responsibility at Gilead Sciences, Inc., or Gilead, from 1996 until his retirement into February 2018. Most2018, most recently he served as Gilead’s Executive Vice President of Worldwide Commercial Operations from November 2016 to February 2018, where he was responsible for global commercial activities, including pricing and market access in North America, Europe, Middle East, Australia and Japan. Mr. Meyers joined Gilead in 1996 where heand successfully led several important25 product launches in the HIV and hepatitis Cseven different therapeutic areas.areas over a 22-year period, including 11 brands with peak annual revenue greater than $1 billion. Prior to Gilead, Mr. Meyers held positions of increasing responsibility with Zeneca Pharmaceuticals and Astra USA. He currently serves on the board of directors of two other public biopharmaceutical companies, Arbutus Biopharma Corporation and CytomX Therapeutics, Inc., and he remains an active advisor to several major biopharmaceutical companies. Mr. Meyers holds aachieved his B.S. in Economics from Boston College. The Nominating and Corporate Governance Committee and the Board believe that Mr. Meyers’ extensive

8

commercial leadership experience in the biotechnology industry provides valuable operational, commercial assessment and management skills to the Board.

H. Stewart Parker, age 64,65, has been a member of our Board of Directors since June 2014, and has been Chair since June 2017. Ms. Parker has over 3040 years of experience in the biotechnology industry. Prior to focusing on boards and consulting, she served as the Chief Executive Officer of The Infectious Disease Research Institute (IDRI), a not-for-profit global health Research institute from March 2011 to December 2013. In 1992, Ms. Parker founded Targeted Genetics Corporation, a publicly traded Seattle-based biopharmaceutical company formed to develop gene-based treatments for acquired and inherited diseases that became a world leader in adeno-associated virus, or AAV, gene therapy. She held the position of President and Chief Executive Officer and was a member of its board of directors from the company’s inception until November 2008. Prior to founding Targeted Genetics, Ms. Parker served in various capacities at Immunex from August 1981 through December 1991, most recently as Vice President, Corporate Development. From February 1991 to January 1993, Ms. Parker served as President and a Director of Receptech Corporation, a company formed by Immunex in 1989 to accelerate the development of soluble cytokine receptor products. She has served on the board of directors

and the executive committee of BIO, the primary trade organization for the biotechnology industry. She currently serves on the board of directors of Armata Pharmaceuticals Inc. and Achieve Life Sciences, Inc., a public pharmaceutical company and previously served on the board of directors of Armata Pharmaceuticals, Inc., a public biotechnology company, from May 2019 to December 2020. Ms. Parker received her B.A. and M.B.A. from the University of Washington. The Nominating and Corporate Governance Committee and the Board believe that Ms. Parker’s senior executive experience in AAV gene therapy and biotechnology drug development provides valuable operational, commercial assessment and management skills to the Board.

Saira Ramasastry, age 44,45, has served as a member of our Board of Directors since June 2012. Since April 2009, she has served as Managing Partner of Life Sciences Advisory, LLC, a company that she founded to provide strategic advice, business development solutions and innovative financing strategies for the life science industry. Ms. Ramasastry also serves on the Industry Advisory Board of the Michael J. Fox Foundation for Parkinson’s Research and as business and sustainability lead for the European Prevention of Alzheimer’s Dementia consortium. From August 1999 to March 2009, Ms. Ramasastry was an investment banker with Merrill Lynch & Co., Inc. where she helped establish the biotechnology practice and was responsible for origination of mergers and acquisitions, or M&A, strategic and capital markets transactions. Prior to joining Merrill Lynch, she served as a financial analyst in the M&A group at Wasserstein Perella & Co., an investment banking firm, from July 1997 to September 1998. Ms. Ramasastry currently serves on the board of directors of Vir Biotechnology, Inc., a public biotechnology company, Glenmark Pharmaceuticals, Ltd., a public pharmaceutical company, and Akouos, Inc., a public genetic medicine company. Ms. Ramasastry previously served on the board of directors of Innovate Biopharmaceuticals, Inc. (now 9 Meters Biopharma, Inc.), a public biopharmaceutical company, from June 2018 to March 2020, and Cassava Sciences, Inc., Vir Biotechnology, Inc., Innovate Biopharmaceuticals, Inc. and Glenmark Pharmaceuticals, Ltd.a public biopharmaceutical company, from February 2013 to June 2020. Ms. Ramasastry received her B.A. in economics with honors and distinction and an M.S. in management science and engineering from Stanford University, as well as an M. Phil. in management studies from the University of Cambridge where she is a guest lecturer for the Bioscience Enterprise Programme and serves on the Cambridge Judge Business School Advisory Council. Ms. Ramasastry is also a Health Innovator Fellow of the Aspen Institute and a member of the Aspen Global Leadership Network. The Nominating and Corporate Governance Committee and the Board believe that Ms. Ramasastry’s extensive experience in global healthcare investment banking and strategic advisory consulting provides valuable financial, commercial assessment and business development skills to the Board and her thorough understanding of our technology and programs provides the Board with valuable insight in the development of our novel genomic and cell therapy assets.

Karen L. Smith, M.D., Ph.D., M.B.A., L.L.M., age 52,53, has served on our Board of Directors since June 2018. Dr. Smith is a life sciences thought leader with over 20 years of biopharmaceutical experience bringing drugs into the clinic and through commercialization. She has been a key contributor to the successful development of multiple FDA and EMA approved products in several therapeutic areas, including oncology (Herceptin, Vyxeos), rare disease (Defitelio), cardiology (Irbesartan), dermatology (Voluma, Botox), neuroscience (Abilify) and anti-infectives (Teflaro). Since November 2018, Dr. Smith has been providing consulting services internationally. Dr. Smith currently serves as Chief Medical Officer for Emergent BioSolutions, Inc., a public biopharmaceutical company. From May 2019 to January 2020, Dr. Smith served as President and Chief Executive Officer of Medeor Therapeutics, Inc., a biotechnology company. From June 2018 to May 2019, Dr. Smith served as Chief Executive Officer of Eliminate Cancer, Inc. From April 2015 to May 2018, she served as the Global Head of Research & Development and Chief Medical Officer of Jazz Pharmaceuticals plc, a biopharmaceutical company, where she built the R&D function into a pipeline of neuroscience and oncology products across all stages of discovery and development. From January 2011 to March 2015, she was Senior Vice President, Global Medical Affairs and Global Therapeutic Area Head (Dermatology) for Allergan, Inc., a multi-specialty health care company. Earlier in her career, she held senior leadership roles at AstraZeneca plc and Bristol Myers Squibb Company. Dr. Smith holds several degrees, including an M.D. from the University of Warwick, a Ph.D. in oncology from the University of Western Australia, an M.B.A. from the University of New England and an L.L.M. (Masters in Law) from the University of Salford. Dr. Smith currently serves on the board of directors of Acceleron Pharma, Inc., a public biopharmaceutical company, and Antares Pharma, Inc. and, a public pharmaceutical company. Dr. Smith previously served on the

9

board of directors of Sucampo Pharmaceuticals, Inc. from July 2017 to February 2018, and Forward Pharma A/S.S, from June 2016 to June 2017, and serves as the chair of the Strategic Advisory Board of Emyria Limited, a healthcare technology and services company. The Nominating and Corporate Governance Committee and the Board believe that Dr. Smith’s extensive executive experience in global research and development, combined with tenure on prior public company boards provides us with access to a valuable skill-set as we translate our science into genomic medicines using our platform technologies in gene editing, gene therapy, gene regulation and cell therapy. In addition, the Nominating and Corporate Governance Committee and the Board do not believe that Dr. Smith’s outside boards or other commitments limit her ability to devote sufficient time and attention to her duties as a director of Sangamo, particularly given her exemplary attendance record at meetings of the Board and of the Compensation Committee.

Joseph S. Zakrzewski, age 57,58, has served as a member of our Board of Directors since June 2017. Mr. Zakrzewski has over 25 years of experience in the biopharmaceutical industry with senior leadership experience in R&D, supply chain and manufacturing operations, business development and commercialization. Prior to focusing on serving on boards and investments, from 2010 through 2013, he was Chairman and Chief Executive Officer of Amarin Corporation PLCplc (formerly Amarin Pharmaceuticals, Inc.), where he led the development and commercialization of the company’s first product, Vascepa. Mr. Zakrzewski previously served as a Venture Partner with Orbimed Advisors LLC, a venture capital firm, and as Chairman, President and Chief Executive Officer of Xcellerex, Inc., a privately held company focused on the commercialization of its proprietary manufacturing technology for biotherapeutics and vaccines. Earlier, he served as Chief Operating Officer of Reliant Pharmaceuticals, Inc. before its acquisition by GlaxoSmithKline in 2007 and held various executive positions at Eli Lilly & Company in the areas of R&D, manufacturing, finance and business development. Mr. Zakrzewski currently serves as a member ofon the board of directors of Acceleron Pharma, Inc., a public biopharmaceutical company, and Amarin.Amarin Corporation plc, a public biopharmaceutical company. Mr. Zakrzewski previously served on the board of directors of Insulet Corporation, a public medical device company, from 2008 to August 2017. Mr. Zakrzewski received ahis B.S. in Chemical Engineering and an M.S. in Biochemical Engineering from Drexel University, and an M.B.A. in Finance from Indiana University. The Nominating and Corporate Governance Committee and the Board believe that Mr. Zakrzewski’s significant experience as a Chief Executive Officer and leading a variety of functional areas including supply and manufacturing operations provides the Board with an important set of skills to assist in the oversight of the development of our novel genomic and cell therapy assets.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends that the stockholders vote FOR the election of each the nominees listed above.

Stockholder Engagement and Responsiveness

A priority for our Board of Directors is soliciting and listening to the views of our stockholders on a variety of topics, including our business and growth strategy, corporate governance practices and executive compensation matters. In this regard, we regularly engage with our institutional investors, and since our 2019 annual meeting of stockholders, we reached out to investors representing over 30% of our outstanding shares. Our discussions with our investors have been productive and informative and have provided valuable feedback to our Board of Directors to help ensure that our Board’s decisions are aligned with stockholder objectives.

Board Independence

The Board of Directors has determined that each of its directors is independent under applicable listing standards of The Nasdaq Stock Market LLC, or Nasdaq, except for Dr. Macrae, who is our Chief Executive Officer. There are no family relationships between any of our directors and any of our executive officers.

Board Committees and Meetings

The Board of Directors held sixseven meetings and acted by unanimous written consent in lieu of a meeting three times during 2019.2020. The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served during 2019,2020, in each case held during the period for which each respective director was serving as a director.

Audit Committee

The Audit Committee consists of three directors: Mr. Carey, Dr. DillyMr. Meyers and Ms. Ramasastry. Dr. DillyMr. Meyers was appointed to serve on the Audit Committee effective in January 2020. Mr. Zakrzewski served onSeptember 30, 2020 to replace Dr. Stephen G. Dilly, a former member of the Board who resigned from the Board and Audit Committee for all of 2019 and was independent under applicable Nasdaq listing standards and SEC rules with respect to audit committee members.effective September 30, 2020. Mr. Carey serves as the ChairmanChair of this committee. Our Board of Directors has determined that each member of the Audit Committee is independent under the applicable listing standards of Nasdaq and SEC rules, and that Dr, Dilly was independent under the applicable listing standards

10

of Nasdaq and SEC rules. The Board of Directors has determined that Mr. Carey is an “audit committee financial expert” as defined under SEC rules and that each member of the Audit Committee has the requisite financial sophistication in accordance with the applicable Nasdaq listing standards. The Audit Committee held four meetings during 2019.2020.

The Audit Committee assistsCommittee’s primary purposes are to (i) assist the Board of Directors in its oversight of the integrity of our financial statements, our systems of accounting and financial controls, our accounting and financial reporting processes and the risk management andaudit of our internal controls and our compliance with legal and regulatory requirements. The Audit Committee interactsfinancial statements, (ii) interact directly with and evaluatesevaluate the performance of theour independent registered public accounting firm, including determiningauditors, determine whether to engage or dismiss theour independent registered public accounting firmauditors and to monitor theour independent registered public accounting firm’sauditors’ qualifications and independence.independence and (iii) oversee the implementation of our compliance program with respect to financial, accounting, auditing, information technology and cybersecurity matters. The Audit Committee also pre-approves all audit services and permissible non-audit services provided by theour independent registered public accounting firm.auditors. The Audit Committee Report is included herein in the section labeled “Report of the Audit Committee of the Board of Directors.” The Audit Committee has a written charter, which is available on our website at https://investor.sangamo.com/corporate-governance/governance-overview.

Compensation Committee

The Compensation Committee consists of three directors: Ms. Parker,Mr. Meyers, Dr. Smith and Mr. Zakrzewski, each of whom is independent under applicable Nasdaq listing standards and SEC rules.Zakrzewski. Mr. Zakrzewski and Dr. Smith wereMeyers was appointed to serve on the Compensation Committee effective in June 2019, after the 2019 annual meeting of stockholders.April 1, 2020. Ms. Parker served on the Compensation Committee until the 2019 annual meeting of stockholders, at which point the Compensation Committee was reconstituted with Mr. Zakrzewski and Dr. Smith. Ms. Parker was reappointed to serve on the Compensation Committee in September 2019. Effective April 1, 2020, the Compensation Committee will be reconstituted with Mr. Zakrzewski, Dr. Smith and Mr. Meyers, each of whom is independent under applicable Nasdaq listing standards and SEC rules. Dr. Roger Jeffs and Dr. Steven Mento, each of whom was independent under applicable Nasdaq listing standards and SEC rules, previously served on the Compensation Committee until their terms expired at the 2019 annual meeting of stockholders when they did not stand for reelection.through March 2020. Mr. Zakrzewski serves as ChairmanChair of this committee. Before Mr. Zakrzewski was appointed toOur Board of Directors has determined that each member of the Compensation Committee Dr. Mento served as Chairmanis independent under the applicable listing standards of this committee.Nasdaq and SEC rules.

The Compensation Committee’s responsibilities include, among other things (i) approving a philosophy for compensation of our executive officers and key employees; (ii) adopting, administering and reviewing compensation and benefit plans and programs for our executive officers and key employees, including incentiveequity and equity plansretirement plans; (iii) approving executive employment contracts and programs; (ii) approving compensation

The Compensation Committee may delegate any responsibility or authority of the Compensation Committee under its charter to one or more members of the Compensation Committee, as appropriate and as consistent with applicable laws and rules. The Compensation Committee does not, however, delegate any of its functions to others in determining or recommending director or executive or directorofficer compensation.

The Compensation Committee is authorized to engage, oversee and terminate independent compensation consultants and other professionals to assist in the design, formulation, analysis and implementation of compensation programs for our executive officers and other key employees. The Compensation Committee retained the services of Radford, awhich is part of the Rewards Solutions practice of Aon plc, or Radford, in order to (i) assess compensation levels and mix of elements for our executive officers and vice presidents for 2019,2020, (ii) review the peer group criteria and to recommend specific companies, (iii) assess the compensation of the non-employee directors and (iv) advise the committeeCompensation Committee on executive compensation and governance trends based on peer group trends and market practices.

The Compensation Committee held fivesix meetings and acted three times by unanimous written consent in lieu of a meeting during 2019.2020. The Compensation Committee has a written charter, which is available on our website at https://investor.sangamo.com/corporate-governance/governance-overview. For information regarding our processes and procedures for the consideration and determination of executive and director compensation, please see “Executive Compensation—Compensation Discussion and Analysis” and “—Director Compensation,” respectively.

Compensation Committee Interlocks and Insider Participation

During 2019,2020, Mr. Meyers, Ms. Parker, Dr. Smith and Mr. Zakrzewski and former directors Drs. Jeffs and Mento served on the Compensation Committee. None of our Compensation Committee members has been an officer or employee of Sangamo at any time. None of our executive officers serves on the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or our Compensation Committee.

11

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of three directors: Dr. Dilly, Mr. MeyersHillan, Dr. Markels and Ms. Parker, each of whom is independent under applicable Nasdaq listing standards. Mr. MeyersParker. Dr. Markels was appointed to serve on the Nominating and Corporate Governance Committee effective in January 2020. Effective April 1, 2020,2020. Dr. Hillan was appointed to serve on the Nominating and Corporate Governance Committee will be reconstituted with Dr. Dilly, Ms. Parker and Dr. Markels, each of whom is independent under applicable Nasdaq listing standards. Dr. Jeffseffective September 30, 2020. Mr. Meyers previously served on the Nominating and Corporate Governance Committee withthrough March 2020, and Dr. Dilly previously served on the Nominating and Corporate Governance Committee until his resignation from our Board of Directors effective September 30, 2020. Ms. Parker until his term expired at the 2019 annual meeting of stockholders when he did not stand for reelection. Dr. Dilly serves as ChairmanChair of this committee. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent under the applicable listing standards of Nasdaq and SEC rules.

The Nominating and Corporate Governance Committee considers and periodically reports on matters relating to the size, identification, selection and qualification of the Board of Directors and candidates nominated for the Board of Directors and its committees, and develops and recommends governance principles and policies applicable to the Company. It also assists the Board in its oversight of our compliance with legal and regulatory requirements relating to matters other than financial, accounting, auditing, information technology and cybersecurity matters.

The Nominating and Corporate Governance Committee held threefour meetings during 2019.2020. The Nominating and Corporate Governance Committee has a written charter, which is available on our website at https://investor.sangamo.com/corporate-governance/governance-overview. The Nominating and Corporate Governance Committee considers properly submitted stockholder recommendations for candidates for membership on the Board of Directors as described below under “—Identification and Evaluation of Nominees for Directors.” In evaluating such recommendations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and to address the membership criteria set forth below under “—Director Qualifications.Qualifications & Composition.”

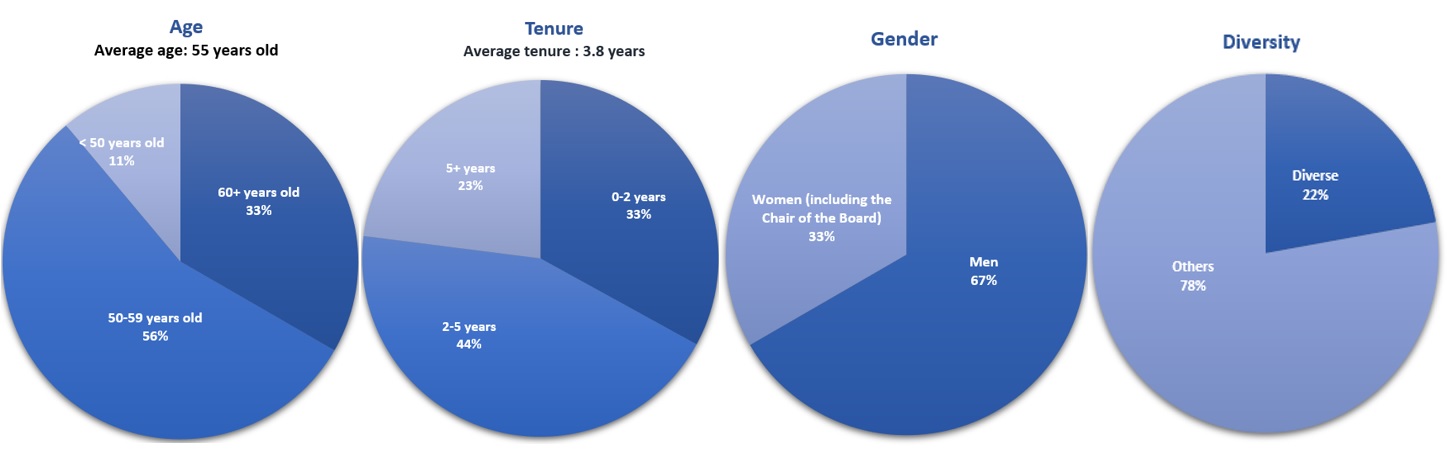

Director Qualifications & Composition

The Nominating and Corporate Governance Committee will use a variety of criteria to evaluate the qualifications and skills necessary for members of our Board of Directors. The Nominating and Corporate Governance Committee may assess character, judgment, business acumen and scientific expertise, and familiarity with issues affecting the biotechnology and pharmaceutical industries. Other qualifications will be determined on a case-by-case basis, depending on whether the Nominating and Corporate Governance Committee desires to fill a vacant seat or increase the size of the Board to add new directors. In addition, the Nominating and Corporate Governance Committee may also evaluate whether a potential director nominee’s skills are complementary to existing Board members’ skills or meet the Board’s need for operations, management, commercial, financial or other expertise. While theThe Nominating and Corporate Governance Committee does not prescribe specificstrives to maintain a diverse Board reflecting a variety of skills, experiences, perspectives and backgrounds, including age, tenure, gender, race, ethnicity, sexual orientation and other unique characteristics, as it believes that such diversity standards,

Identification and Evaluation of Nominees for Directors

The Nominating and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Nominating and Corporate Governance Committee assesses the appropriate size of the Board of Directors, and whether any vacancies on the Board of Directors are expected due to retirement or otherwise. In the event that

12

vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current members of the Board of Directors or senior management, executive recruiting firms, stockholders or other persons. For example, Dr. Hillan was initially recommended to the Nominating and Corporate Governance Committee by our Chief Executive Officer upon the recommendation of another Board Director. In addition, we have in the past and may from time to time again in the future engage a third-party search firm to assist in identifying potential directors. For example, we engaged a search firm to conduct a search on our behalf for a new director with extensiveThe Board often considers specific industry expertise such as research, development or commercial and operational experience in candidates to make sure the life sciences industry, and this search firm identified and recommended Mr. Meyers as a director candidate with the relevant experience.Board is able to oversee all aspects of our business. Candidates for director are evaluated at regular or special meetings of the Nominating and Corporate Governance Committee and may be considered at any point during the year. The Nominating and Corporate Governance Committee will consider properly submitted stockholder recommendations for candidates for the Board of Directors. Nominees recommended by stockholders will receive the same consideration that nominees of the Board receive. Any stockholder recommendations proposed for consideration by the Nominating and Corporate Governance Committee must provide all information requested by the Nominating and Corporate Governance Committee relating to such recommendation, including the candidate’s name and qualifications for membership on the Board of Directors and should be addressed to Investor Relations at the following address:

Investor Relations Department

Sangamo Therapeutics, Inc.

7000 Marina Boulevard

Brisbane, CA 94005

In evaluating such recommendations, the Nominating and Corporate Governance Committee applies the qualifications standards discussed above and seeks to achieve a balance of knowledge, experience and capability on the Board of Directors.

Leadership Structure of the Board

Under our Bylaws, the Board is not required to appoint our Chief Executive Officer as the Chair of the Board, and the Board does not have a policy on whether or not the roles of Chief Executive Officer and Chair of the Board should be separate. Currently two individuals serve in these two positions. Ms. Parker currently serves as the Chair of the Board. Ms. Parker has extensive knowledge and experience in the life science industry and an in-depth understanding of our business strategies and day-to-day operations, which makes her well suited to set the agenda and lead the discussions at Board meetings as the Chair. The Chair is responsible for chairing Board meetings and meetings of stockholders, setting the agenda for Board meetings and providing information to the Board members in advance of meetings and between meetings. In addition, our Chief Executive Officer, Dr. Macrae, also serves as a director on our Board. The Board believes that Dr. Macrae’s membership as a director provides the Board with an in-depth understanding of our business operations because of his extensive experiencesexperience and knowledge of the day-to-day management of all aspects of our operations. This also facilitates communications between the Board and management by ensuring a regular flow of information, thereby enhancing the Board’s ability to make informed decisions on critical issues facing our company.

Of the nine directors on the Board following the Annual Meeting, eight directors are independent under applicable Nasdaq corporate governance rules. The Board believes that this establishes a strong independent board that provides effective oversight of the Company. Moreover, in addition to feedback provided during the course of Board meetings, the independent directors conduct regular executive sessions without the presence of Dr. Macrae or any other members of management. We believe that our leadership structure of the Board is appropriate given the nature and size of our business, because it provides both effective independent oversight and expertise in the complexity and management of our operations as a life sciences company.

Oversight of Risk Management by the Board

Our Board of Directors is generally responsible for the oversight of corporate risk in its review and deliberations relating to our activities. The Audit Committee oversees management of risks associated with our financial and accounting systems, public financial reporting, investment strategies and policy, and certain other matters delegated to the Audit Committee, including risks associated with our information technology systems (including cybersecurity risks). Our Board of Directors regularly reviews information regarding our cash position, liquidity and operations, as well as the risks associated with each. The Board regularly

reviews plans, results and potential risks related to our lead therapeutic development programs and other preclinical programs as well as financial and strategic risks related to our business and operations.

In addition, the Nominating and Corporate Governance Committee monitors the effectiveness of our corporate policies and manages risks associated with the independence of the Board of Directors and potential conflicts of interest. Our Compensation Committee oversees risk management as it relates to our compensation plans, policies and practices for all employees, including executives, particularly whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks that could have a material adverse effect on the Company. While each committee is

13

responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularlyperiodically informed through committee reports about such risks. ForIn May 2020, upon the request of the Board, has requested the creation of a Compliance Committee which will bewe established an internal compliance committee staffed by employees led by our General Counsel and reportChief Compliance Officer, who reports directly to the Board.Board on compliance matters. The Compliance Committee will have its first meetingcompliance committee held quarterly meetings in 2020, starting with the second quarter of 2020. Separately, we have createdquarter. We also established a Corona virus task force that isCOVID-19 Taskforce in 2020 responsible for developing our internal COVID-19 policies and protocols. This Taskforce meets regularly and was led by theour former Chief Financial Officer in 2020 and reports up to the Board through theis now led by our Chief Financial Officer and the Chief ExecutivePeople Officer.

Annual Meeting Attendance

Although we do not have a formal policy regarding attendance by members of the Board of Directors at our annual meetings of stockholders, we encourage our directors are encouraged to attend annual meetings of our stockholders. Other than Ms. Ramasastry, allAll of our then current directors who were nominated for re-election attended the 20192020 annual meeting of stockholders.stockholders, which was held online-only in light of public health concerns regarding the ongoing COVID-19 pandemic.

Communications with the Board of Directors

Our Board of Directors currently does not have a formal process for stockholders to send communications to the Board of Directors. Although we do not have a formal policy regarding communications with the Board of Directors, stockholders may communicate with the Board of Directors, including the non-management directors, by sending a letter to the Sangamo Board of Directors, c/o Investor Relations, 7000 Marina Boulevard, Brisbane, California 94005. Stockholders who would like their submission directed to a particular member of the Board of Directors may so specify. The Board of Directors does not recommend that formal communication procedures be adopted at this time because it believes that informal communications are sufficient to communicate questions, comments and observations that could be useful to the Board.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics, which is applicable to all employees, including our executive officers, and directors of the Company. A copy of our Code of Business Conduct and Ethics is available on our website at https://investor.sangamo.com/corporate-governance/governance-overview in the Investors + Media Section under Corporate Governance. In the event that we make any amendments to or grant any waivers of, a provision of the Code of Business Conduct and Ethics that applies to the principal executive officer, principal financial officer, or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose such amendment or waiver and the reasons therefore,therefor, on our website.

Prohibitions on Hedging, Pledging and Speculative Transactions

Under the terms of our insider trading policy, none of our directors, officers and other employees may engage in any hedging or monetization transactions relating to our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds. In addition, all of our officers, directors and employees are prohibited from short-selling our securities or engaging in transactions involving Sangamo-based derivative securities (other than those granted under our employee stock option or equity incentive plans), and are further prohibited from holding our securities in a margin account or otherwise pledging our securities as collateral for a loan.

Director Compensation

The following table sets forth certain information regarding the compensation of each non-employee director for service as a member of the Board of Directors during 2019.2020. Dr. Macrae, our President and Chief Executive Officer, is not listed in the following table because he is our employee. Dr. Macrae’s compensation is described under “Executive Compensation” and he received no additional compensation for serving on our Board of Directors in 2019. In addition, Dr. Markels is not listed in2020.

14

| Name | Fees Earned or Paid in Cash ($) (1) | Option Awards ($) (2) (3) (5) | Stock Awards ($) (2) (4) (6) | Total ($) | ||||||||||||||||||||||

| Robert F. Carey | 60,000 | 135,572 | 104,600 | 300,172 | ||||||||||||||||||||||

| Stephen G. Dilly (7) | 45,000 | 135,572 | 104,600 | 285,172 | ||||||||||||||||||||||

| Kenneth J. Hillan (8) | 13,655 | 200,988 | 156,450 | 371,093 | ||||||||||||||||||||||

| John H. Markels (9) | 43,750 | 147,900 | 38,000 | 229,650 | ||||||||||||||||||||||

| James R. Meyers | 49,402 | 135,572 | 104,600 | 289,574 | ||||||||||||||||||||||

| H. Stewart Parker | 83,152 | 135,572 | 104,600 | 323,324 | ||||||||||||||||||||||

| Saira Ramasastry | 50,000 | 135,572 | 104,600 | 290,172 | ||||||||||||||||||||||

| Karen L. Smith | 47,500 | 135,572 | 104,600 | 287,672 | ||||||||||||||||||||||

| Joseph S. Zakrzewski | 55,000 | 135,572 | 104,600 | 295,172 | ||||||||||||||||||||||

___________________

(1)Consists of the following table since he joined ourannual retainer fee for service as a member of the Board of Directors or any Board committee. For further information concerning such fees, see the section below entitled “—Director Annual Retainer and Meeting Fees.”

(2)Represents the grant date fair value of the awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation, or ASC 718. The assumptions used in the calculation of such grant date fair values are described in Note 9 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on February 24, 2021, or the 2020 Form 10-K.

(3)Pursuant to the automatic grant program under our Amended and Restated 2018 Equity Incentive Plan, or the 2018 Plan, Mr. Carey, Dr. Dilly, Mr. Meyers, Ms. Parker, Ms. Ramasastry, Dr. Smith and Mr. Zakrzewski each received no compensationan option to purchase 20,000 shares of common stock with an exercise price per share of $10.46 on the date of the 2020 annual meeting of stockholders, and each such option had an aggregate grant date fair value of $135,572. On February 11, 2020, Dr. Markels received an option to purchase 30,000 shares of common stock with an exercise price per share of $7.60 in connection with his appointment to the Board of Directors and such option had an aggregate grant date fair value of $147,900. On September 9, 2020, Dr. Hillan received an option to purchase 30,000 shares of common stock with an exercise price per share of $10.43 in connection with his appointment to the Board of Directors and such option had an aggregate grant date fair value of $200,988.

(4)Pursuant to the automatic grant program under the 2018 Plan, Mr. Carey, Dr. Dilly, Mr. Meyers, Ms. Parker, Ms. Ramasastry, Dr. Smith and Mr. Zakrzewski each received an award of 10,000 restricted stock units, or RSUs, on the date of the 2020 annual meeting of stockholders and each such RSU award had an aggregate grant date fair value of $104,600. On February 11, 2020, Dr. Markels received an award of 5,000 RSUs in connection with his appointment to the Board of Directors and such RSU award had an aggregate grant date fair value of $38,000. On September 9, 2020, Dr. Hillan received an award of 15,000 RSUs in connection with his appointment to the Board of Directors and such RSU award had an aggregate grant date fair value of $156,450.

(5)As of December 31, 2020, the following non-employee directors held options to purchase the following number of shares of our common stock: Mr. Carey, 90,000 shares; Dr. Hillan, 30,000 shares; Dr. Markels, 30,000 shares; Mr. Meyers, 50,000 shares; Ms. Parker, 130,000 shares; Ms. Ramasastry, 90,000 shares; Dr. Smith, 65,000 shares; and Mr. Zakrzewski, 80,000 shares.

(6)As of December 31, 2020, the following non-employee directors held RSUs for the following number of shares of our common stock: Mr. Carey, 10,000 shares; Dr. Hillan, 15,000 shares; Dr. Markels, 5,000 shares; Mr. Meyers, 13,333 shares; Ms. Parker, 10,000 shares; Ms. Ramasastry, 10,000 shares; Dr. Smith, 11,667 shares; and Mr. Zakrzewski, 10,000 shares.

(7)Dr. Dilly resigned from Sangamothe Board of Directors effective September 30, 2020; accordingly, his retainer fees were prorated over his period of service in any capacity during 2019.2020.

(8)Dr. Hillan was appointed as a non-employee member of the Board of Directors on September 9, 2020; accordingly, his retainer fees were prorated over his period of service in 2020.

(9)Dr. Markels was appointed as a non-employee member of the Board of Directors on February 11, 2020; accordingly, his retainer fees were prorated over his period of service in 2020.

| Name | Fees Earned or Paid in Cash ($) (1) | Option Awards ($) (2) (3) (5) | Stock Awards ($) (2) (4) (6) | Total ($) | ||||||||

| Robert F. Carey | 60,000 | 92,862 | 23,450 | 176,312 | ||||||||

| Stephen G. Dilly | 45,000 | 92,862 | 23,450 | 161,312 | ||||||||

| Roger Jeffs (7) | 28,750 | — | — | 28,750 | ||||||||

| Steven J. Mento (7) | 27,500 | — | — | 27,500 | ||||||||

| James R. Meyers (8) | 10,000 | 190,758 | 54,000 | 254,758 | ||||||||

| H. Stewart Parker | 87,500 | 92,862 | 23,450 | 203,812 | ||||||||

| Saira Ramasastry | 50,000 | 92,862 | 23,450 | 166,312 | ||||||||

| Karen L. Smith | 45,625 | 92,862 | 23,450 | 161,937 | ||||||||

| Joseph S. Zakrzewski | 61,250 | 92,862 | 23,450 | 177,562 | ||||||||

Processes and Procedures for Determining Director Compensation

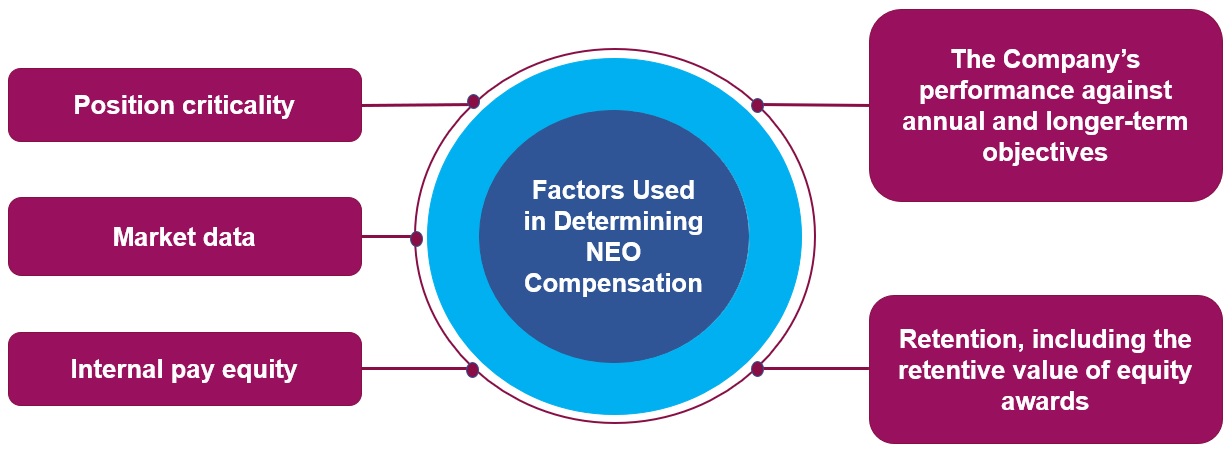

The charter of the Compensation Committee provides the Compensation Committee with the responsibility for reviewing, considering and approving compensation programs applicable to non-employee directors. It is the practice of the Compensation Committee to seek input from outside compensation consultants, including Radford, our Compensation Committee’s compensation consultant, as it deems appropriate.